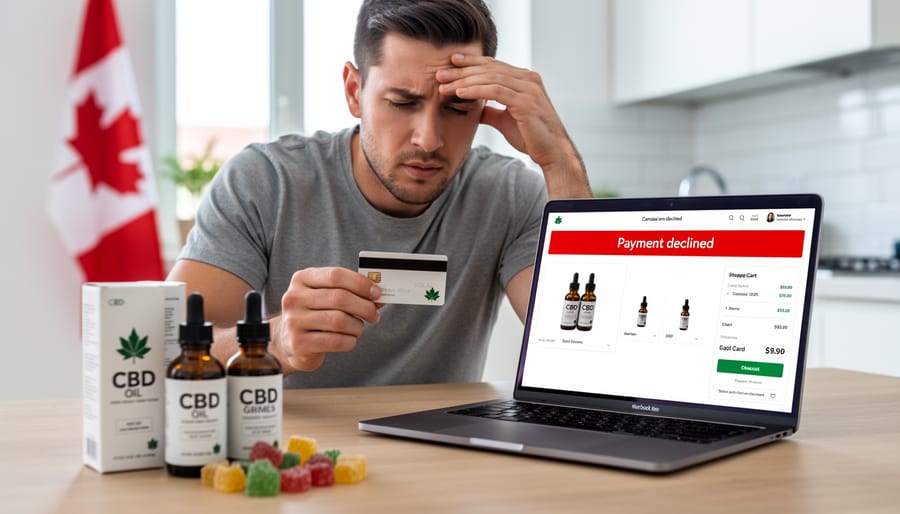

Trying to buy CBD oil online and watching your payment get declined isn’t a personal failure—it’s a systemic banking issue affecting Canadian CBD consumers and businesses alike. Despite CBD being federally legal in Canada since 2018, many payment processors still classify it as “high-risk,” leading traditional banks and credit card companies to restrict or refuse transactions entirely. This disconnect between legality and financial accessibility creates real frustration: you’ve found the perfect product for your wellness needs, but can’t actually complete the purchase.

The good news? Multiple proven payment solutions exist that work reliably for Canadian CBD purchases. Understanding why these payment barriers exist—and which alternative methods Canadian retailers commonly accept—means you’ll never face a declined cart again. Whether you’re a consumer searching for payment options that actually work or a business owner navigating merchant account restrictions, knowing the landscape of CBD payment processing in Canada transforms a confusing roadblock into a manageable challenge. The key lies in recognizing that this isn’t about product legality, but rather about financial institutions’ risk assessments and the practical workarounds that have emerged to serve Canada’s growing CBD market.

The Real Reason Behind CBD Banking Restrictions in Canada

What Makes CBD a ‘High-Risk’ Business

Even though CBD is federally legal in Canada under the Cannabis Act, banks and payment processors still label it as “high-risk.” This designation affects both consumers trying to make purchases and business owners seeking reliable payment solutions. Understanding why this happens can help you navigate the challenges more effectively.

The primary concern for financial institutions is chargebacks. When customers dispute charges or request refunds, payment processors must handle the administrative burden and potential losses. CBD products historically see higher chargeback rates than traditional retail, partly because consumers sometimes have unrealistic expectations about effects or misunderstand product descriptions. Banks view this pattern as financially risky, even when the business operates legally.

Regulatory uncertainty compounds the issue. While Canada has clear federal regulations, international banking systems don’t always distinguish between Canadian CBD (legal) and CBD in countries where it remains prohibited. Many payment processors operate across borders, and navigating different legal frameworks creates compliance headaches they’d rather avoid.

There’s also the reputational factor. Some financial institutions maintain conservative policies, treating all cannabis-related products with extra caution regardless of legal status. They worry about potential regulatory changes or public perception issues.

From a consumer perspective in Canada, this means your card might get declined not because you’re doing anything wrong, but because automated fraud detection systems flag CBD purchases as suspicious. For business owners, it translates to limited payment processor options, higher processing fees, and stricter account requirements. These aren’t insurmountable obstacles, but they require specific strategies to work around effectively.

How This Affects You as a Consumer

If you’ve ever had your card declined while purchasing CBD products online, you’re definitely not alone. I remember trying to buy my first CBD oil last year, and my transaction was rejected three times before I figured out what was happening. It wasn’t my bank account or credit limit – it was the payment processor flagging CBD as a high-risk purchase.

As a Canadian CBD consumer, you might encounter several frustrating scenarios. Your usual credit card may suddenly stop working on CBD websites, even though it works everywhere else. Some retailers only accept e-transfers or wire transfers, which feels less secure and takes longer to process. You might even find that certain online stores can’t ship to your province because they can’t process payments there.

The good news is these restrictions aren’t about CBD being illegal in Canada – it’s completely legal for adult use. The challenge stems from international banking regulations and payment processors being overly cautious. Many payment companies operate globally and apply stricter rules across all regions rather than differentiating between countries.

What does this mean practically? Always have a backup payment method ready when shopping for CBD products. Keep some flexibility in your purchasing timeline, and don’t wait until you’re completely out of product to reorder.

CBD Payment Methods That Actually Work in Canada

Debit Card and Interac E-Transfer

If you’re a Canadian CBD consumer, debit cards and Interac e-Transfer are your best friends when it comes to reliable payment options. Here’s why they work so well where credit cards often fail.

Unlike credit card networks that involve multiple financial institutions and cross-border regulations, Interac operates as a uniquely Canadian payment system. It’s a direct bank-to-bank transfer that doesn’t go through the same credit processors that flag CBD purchases. This means your transaction doesn’t get caught in the same regulatory web that causes credit card declines. When I first started buying CBD online, I learned this the hard way after my credit card was declined three times in a row. Switching to debit was an instant solution.

Most Canadian CBD retailers accept debit cards for online purchases, though you’ll want to confirm this before checkout. The transaction appears as a standard purchase from the retailer’s business name on your bank statement, nothing that specifically flags it as CBD-related.

Interac e-Transfer has become increasingly popular for CBD purchases, especially with smaller retailers or for larger orders. The process is straightforward: the retailer provides their email address, you initiate the transfer through your online banking, and they ship once payment is confirmed. Some customers appreciate the added privacy this method provides, though it does require an extra step compared to standard checkout.

One practical tip: always keep your debit card information current with retailers you trust. This makes repeat purchases seamless and avoids the frustration of declined payments that can happen with credit cards.

Specialized CBD Payment Processors

The good news is that specialized payment processors have emerged specifically to serve the cannabis and CBD industries in Canada. These companies understand the unique regulatory landscape and are designed to work within it, offering solutions that traditional processors won’t touch.

These specialized processors typically work by partnering with financial institutions that are comfortable with the cannabis space. They’ve built relationships with banks that understand Health Canada’s regulations and are willing to process CBD transactions. For business owners, this means access to standard merchant services like point-of-sale systems, online payment gateways, and even subscription billing options that would otherwise be unavailable.

What sets these processors apart is their expertise. They stay current with changing cannabis regulations, help businesses maintain compliance, and provide customer support that actually understands your industry. Many also offer higher approval rates for merchants who’ve been rejected by mainstream processors.

However, there are trade-offs. Specialized CBD payment processors typically charge higher fees than traditional processors, sometimes significantly so. You might see rates anywhere from 3.5% to 8% per transaction, compared to 2-3% for standard retail. There may also be monthly minimums, setup fees, or volume requirements.

Some processors also have limitations on which CBD products they’ll support. For instance, they might only work with Health Canada-approved products or require extensive documentation proving your compliance. Processing times can be longer too, with funds taking several days to reach your account rather than next-day settlement.

For consumers, the downside is simpler: fewer retailers use these specialized systems, which means you might still encounter payment issues depending on where you shop.

Credit Cards: Hit or Miss

Here’s the reality: credit card processing for CBD purchases in Canada is unpredictable at best. One day your Visa goes through smoothly, the next week the same retailer declines it. This inconsistency frustrates many Canadian CBD shoppers who just want a straightforward checkout experience.

From what I’ve observed helping friends navigate CBD purchases, Visa and Mastercard debit cards tend to have slightly better success rates than credit cards. Why? Banks often view debit transactions as lower risk since you’re spending your own money rather than borrowing credit. That said, it’s still not guaranteed.

When your card gets declined, don’t panic or assume there’s something wrong with your account. First, contact the retailer’s customer service—they might suggest alternative payment methods they accept. Second, try a different card if you have one. Some shoppers find that smaller credit unions or online banks have fewer restrictions than major banks.

My friend Danielle shared that she keeps a prepaid Visa specifically for CBD purchases after her primary credit card repeatedly declined transactions. While it adds an extra step, it’s worked reliably for her. If all else fails, most reputable Canadian CBD retailers offer e-transfer options, which bypass credit card processing issues entirely.

Cash on Delivery and In-Person Payments

Sometimes the simplest solutions are the most reliable. If you’re buying CBD locally in Canada, cash on delivery or paying in person eliminates payment processing headaches entirely. I’ve found this particularly useful when purchasing from local dispensaries or farmers’ markets where vendors appreciate the straightforward transaction without worrying about merchant account complications.

For cash on delivery orders, you’ll typically arrange payment through direct contact with the seller, receiving your products at your doorstep before handing over payment. This method offers peace of mind since you can inspect products before paying, though it’s generally limited to local or regional suppliers who offer delivery services.

In-person payments work best for brick-and-mortar CBD shops across Canada. You can use cash, debit, or sometimes credit cards that the retailer has managed to secure processing for. The advantage here is immediate product access and the opportunity to ask questions directly.

Security-wise, always verify you’re dealing with legitimate businesses. Check for proper licensing, read reviews, and start with smaller purchases if you’re trying a new vendor. While these methods skip online payment issues, standard consumer caution still applies.

Cryptocurrency Options

Cryptocurrency is becoming a payment option for some Canadian CBD retailers, particularly those targeting tech-savvy shoppers. Bitcoin and Ethereum are the most commonly accepted digital currencies. While crypto offers privacy and bypasses traditional banking restrictions that plague CBD merchants, it comes with accessibility challenges. Most Canadians don’t own cryptocurrency, and the learning curve can be steep for first-time buyers. You’ll need to set up a digital wallet and purchase crypto through an exchange before making your CBD purchase. Currently, only a handful of Canadian CBD retailers accept cryptocurrency, typically smaller online shops rather than major retailers. Transaction fees can also be higher than traditional payments, and price volatility means your purchase cost might fluctuate while processing. If you’re already comfortable with crypto, it’s worth asking your preferred retailer if they accept it, but don’t expect widespread adoption yet.

What to Do When Your Payment Gets Declined

Questions to Ask Your Bank

Before exploring alternative payment methods, it’s worth checking directly with your bank to understand their specific policies. When I first encountered payment issues with CBD purchases, I was surprised to learn that simply asking the right questions helped clarify my options.

Start by calling your bank’s customer service line and ask: “Does your bank process CBD transactions?” Follow up with “Are there specific restrictions on legal CBD purchases in Canada?” Some financial institutions distinguish between recreational cannabis and CBD products, so clarify which category applies to your situation.

If they do block CBD payments, ask “Is there a way to pre-authorize specific CBD merchants?” or “Can I request an exception for legal CBD purchases?” Some banks will whitelist trusted Canadian retailers if you provide transaction details in advance.

Also inquire about “What triggers a declined CBD transaction?” Understanding whether it’s merchant category codes, specific keywords, or vendor histories causing blocks can help you troubleshoot future purchases. Finally, ask “Do you offer alternative accounts or cards with different processing rules?” Business accounts sometimes have more flexibility than personal ones.

Working with CBD Retailers

Most established Canadian CBD retailers have adapted to payment processing challenges by offering multiple checkout options. When I first started purchasing CBD online, I noticed the best retailers typically accept Interac e-Transfer, which has become the most reliable method across the country. Many also provide detailed payment instructions during checkout to help first-time buyers navigate the process smoothly.

Reputable sellers often maintain dedicated customer service teams who can walk you through payment alternatives if your card gets declined. They understand this frustration is common and not a reflection on you as a customer. Some retailers even offer phone support specifically for payment-related questions.

Look for CBD shops that clearly display their accepted payment methods on their website before you start shopping. The most customer-friendly retailers will also send confirmation emails with step-by-step payment guidance and typically hold your order for 24-48 hours while you complete an e-Transfer, giving you time to arrange payment without rushing.

The Future of CBD Payment Processing in Canada

The good news? CBD payment processing in Canada is heading in a more consumer-friendly direction. While we’re not quite there yet, there are some promising developments on the horizon that should make purchasing your CBD products much easier.

As CBD becomes increasingly mainstream and the government collects more data showing its safety profile, we’re likely to see financial institutions gradually warming up to this industry. I’ve spoken with several payment processors who’ve mentioned they’re reviewing their CBD policies, recognizing that the current restrictions aren’t necessarily aligned with Canadian law. This reassessment could mean more traditional payment options becoming available within the next few years.

Regulatory clarity is also improving. Health Canada continues to refine its oversight of CBD products, which should give financial institutions more confidence in working with legitimate CBD retailers. When banks and credit card companies see consistent enforcement and clear guidelines, they’re typically more willing to process transactions in that space.

For consumers, this means you can expect a future where paying for CBD is as straightforward as buying any other wellness product. Digital wallets and alternative payment methods are also evolving rapidly, offering more secure and convenient options even before traditional credit cards fully catch up.

My advice? Stay patient but informed. The landscape is changing, and while it might feel frustrating now, the trajectory is definitely moving toward simpler, more accessible payment solutions for Canadian CBD consumers. Keep an eye on your favourite retailers’ payment options, as many are actively working to expand them.

Finding CBD Retailers with Reliable Payment Options

When I first started buying CBD online in Canada, I assumed every retailer would have straightforward checkout systems. I quickly learned that wasn’t the case. Finding sellers with reliable payment options takes a bit of detective work, but it’s worth the effort to avoid frustration.

Start by checking the payment methods listed on a retailer’s website before adding anything to your cart. Trustworthy sellers typically display clear payment options on their homepage or FAQ section. If you can’t find this information easily, that’s your first red flag. Legitimate businesses want to be transparent about how you can pay them.

Look for retailers that offer multiple payment alternatives. Sites accepting Interac e-Transfer, cryptocurrency, or direct bank transfers alongside credit cards tend to have more experience navigating CBD payment challenges. They’ve clearly adapted to the reality of Canadian CBD commerce.

Before making your first purchase, don’t hesitate to contact customer service with questions. Ask specifically about their payment success rate and whether they’ve had recent issues with declined transactions. A responsive, knowledgeable team that acknowledges potential payment hiccups is far more reliable than one that pretends problems don’t exist.

Watch out for retailers with checkout pages that redirect multiple times to unfamiliar payment processors. While some redirection is normal, excessive bouncing between sites can indicate unstable or questionable payment infrastructure. Similarly, be cautious of sellers requesting unusual payment methods or asking you to send payments to personal accounts rather than business accounts.

Reading recent customer reviews specifically mentioning payment experiences can also reveal patterns of reliability or ongoing issues.

Navigating CBD payment processing in Canada doesn’t have to feel like an impossible puzzle. While the challenges are real—stemming from banking regulations, risk assessments, and the evolving legal landscape—workable solutions absolutely exist for both consumers and businesses. The key is knowing which payment methods tend to succeed and having backup options ready.

If you’ve experienced declined payments, you’re not alone, and it’s not a reflection on you or the legitimacy of your purchase. I’ve personally had to try three different payment methods for a single CBD order, and now I always keep my debit card as a backup to my credit card. Don’t hesitate to reach out to customer service teams; reputable Canadian CBD retailers understand these frustrations and often have helpful workarounds or preferred payment methods they can suggest.

For business owners, partnering with specialized high-risk payment processors or exploring cryptocurrency options can open doors that traditional banking keeps closed. The landscape is gradually improving as CBD becomes more mainstream.

Remember, persistence pays off. Whether you’re making your first CBD purchase or your fiftieth, having multiple payment methods at your disposal will save you time and frustration. The right solution is out there—sometimes it just takes a bit of trial and error to find what works best for your situation.